I work as a freelance teacher of English. Just recently, I’ve been pondering over whether to create a startup or conduct unregistered business activity in Poland. The latter option is possible after the so-called “Business Constitution” came into being in 2018. As things stand, there are no legal restrictions which prevent a foreigner from conducting unregistered activity in Poland, providing that certain conditions are met. This post highlights what options are on the table for foreign entrepreneurs who, initially or more permanently, expect to earn less than half of the minimum monthly wage in Poland.

PiS’s “Business Constitution” package

From 30 April, 2018, the “Business Constitution” (Konstytucja Biznesu) – a package of five laws aimed at facilitating business activity – came into force in Poland.

In some quarters, the package of five acts became known as the “Morawiecki Package”. Between 2016-2018, Mateusz Morawiecki, Prime Minister of Poland since 2017, was then the Minister of Development and Finance in the Law and Justice party (PiS).

Morawiecki outlined his plans for the Business Constitution in a November 2016 document tied to the Ministry of Development. Roughly translated, Morawiecki wrote the following:

“… What has created today’s economic powers is based on a good-quality partnership between the public administration and the entrepreneur.

That is why, with the significant participation of the business community, we have developed the largest economic law reform since 1989…

The Business Constitution, which is a key element of our package of changes, is a response to the imperfections of the existing regulations, which are unable to fully implement the guarantees of economic freedom enshrined in the Constitution of the Republic of Poland.”

For the purposes of this post, and my current thoughts pertaining to carrying out unregistered business activity in Poland, I am concerned with only the Entrepreneurs’ Law Act.

Unregistered business activity in Poland – A chance for those who want to find their feet as entrepreneurs

Having shared the main background information about the Business Constitution, I will now delve into the ins and outs of conducting non-registered business activity in Poland.

What is the nature of unregistered business activity?

Unregistered activity (działalność nierejestrowa, also known as działalność nierejestrowna and działalność nieewidencjonowana) describes minor gainful activity of natural persons.

Such unregistered activity is not considered as business activity due to the low level of income. This is despite the fact that an entrepreneur’s operation is of a gainful nature, and is conducted both in one’s own name and on a continuous basis.

The very nature of ‘unregistered activity’ ensures entrepreneurs can conduct small-scale, occasional activities without registering a business in the CEIDG (Centralna Ewidencja i Informacja o Działalności Gospodarczej). This is the Polish Central Register and Information on Economic Activity, i.e. a register of sole proprietorships operating Poland.

All in all, carrying out unregistered activity enables entrepreneurs to take their first steps in business, without the need to fulfil a number of administrative and fiscal obligations related to registered business activity. Moreover, minor entrepreneurs can avoid paying social insurance premiums.

Can all foreigners conduct non-registered activities in Poland?

Not all foreigners are able to conduct unregistered activities in Poland. According to Polish law, this type of activity can be carried out by foreigners who are also able to register as a sole trader (jednoosobowa działalność gospodarcza) for example:

- Foreigners who are citizens of a state-member of the European Union or the European Economic Area (EEA);

- Those with a permanent residence permit in Poland;

- Foreigners with a long-term residence permit for the EU;

- Those with a temporary residence permit, be it for family reunification or any other reason;

- Foreigners married to a Polish citizen;

- Foreigners who have a permit for temporary residence for the purpose of living;

- Foreigners with a valid Polish card.

What conditions must be met in order to carry out unregistered business activity in Poland?

According to Article 5 of the Entrepreneurs’ Law Act, an entrepreneur may carry out unregistered activity if the following conditions are met:

- the revenue does not exceed 75% of the minimum wage in any month. The minimum remuneration for work from July 1, 2023 is PLN 3,600 gross. Therefore, the income limit for unregistered activity is PLN 2,700 gross.

- the entrepreneur has not conducted business activity in the last 60 months (i.e. 5 years);

- Persons authorised to conduct unregistered business activity are also persons who in the period between April 30, 2017 and April 29, 2018 were not entered into the CEIDG or were deleted before April 30, 2017.

Examples of unregistered business activities

Examples of professional activities that can be performed without registering a company include:

- Hairdressing and cosmetic services;

- SEO services;

- Internet marketing;

- Online training and courses, especially language tutoring (korepetycje);

- Agricultural retail – plant and animal products;

- Sale of handmade products.

When is it not possible to run an unregistered business in Poland?

An entrepreneur cannot perform unregistered activity if the undertaking of a given activity requires a permit, licence or entry in the register of regulated activities (Rejestr działalności regulowanej – RDR). Registers of regulated activity are public. The register discloses company data, NIP number or – at the request of the authority – other data.

Furthermore, unregistered activity can’t be conducted as part of a civil law partnership.

Examples of business activities that require a permit, licence or entry in the register of regulated activities are:

- The protection of people or property;

- Sale of alcohol;

- Organisation of tourist events;

- Detective services;

- Waste collection.

Examples of business activities that have been defined as economic activity within the meaning of the Entrepreneurs’ Law Act include:

- Insurance brokerage (in accordance with the Act on Insurance Distribution);

- Bookkeeping services (in accordance with the Accounting Act).

Which services require entrepreneurs who carry out unregistered activity to register transactions using a cash register?

The obligation to register transactions using the cash register, regardless of the amount of income obtained, applies to, among others:

- Hairdressing;

- Cosmetic and cosmetology services;

- Transportation of passengers and their hand luggage by taxi;

- Motor vehicle and moped repair;

- Catering services;

- Cultural and entertainment services.

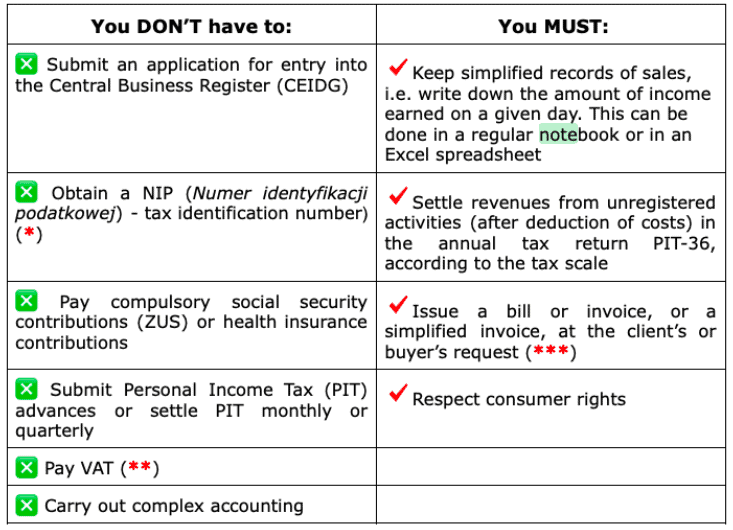

A summary of the obligations and exceptions when running an unregistered business venture in Poland:

* What is NIP in Poland?

A NIP (Numer identyfikacji podatkowej) is a tax identification number. It consists of 10 digits, where the first three digits are codes provided by the tax office. The last digit is a control number.

The obligation to register transactions with the use of a cash register, as well as conducting activities that are not exempt from VAT due to the value of sales, make it necessary to obtain a NIP number. This applies to both registered and unregistered businesses.

** VAT exemption in Poland

A person conducting unregistered activity is, as a rule, exempt from VAT as revenues from unregistered activities will not exceed PLN 200,000 PLN per year.

However, certain types of activity are subject to VAT, as with the provision of legal and consulting services, the supply of products made of sheet metal, and goods subject to excise duty.

*** Issuing invoices and bills for unregistered business activity

A person conducting unregistered activity is generally exempt from the obligation to issue an invoice. The entrepreneur must do so only if the request for its issuance was made within three months from the end of the month in which the goods were delivered or the service was performed. Nevertheless, even in this case it may be a simplified invoice, containing only the following:

- date of issue;

- sequential invoice number;

- names and surnames or names of the taxpayer and the buyer of goods or services and their addresses;

- name (type) of goods or services;

- the measure and quantity (number) of the goods delivered or the scope of the services provided;

- the unit price of a good or service;

- the total amount of receivables.

In the case of unregistered sales, it is enough to provide only one’s name and surname on the bill or invoice. It’s not obligatory to provide a PESEL number or address of residence.

FAQ – Unregistered business activity in Poland

Who can carry out unregistered activity in Poland?

Only a natural person may conduct unregistered business activity in Poland. The provisions governing the conduct of business and unregistered activities do not indicate the specific characteristics of such a person.

Can minors conduct unregistered entrepreneurial activities in Poland?

Unregistered activities may be conducted by minors. However, it should be remembered that a person between the ages of 13 and 18 has limited legal capacity, thus preventing him/her from concluding contracts. Therefore, for this purpose, the consent of the statutory representative, i.e. parents or a guardian, is required.

Can an unemployed person registered in the Labour Office carry out unregistered gainful activities in Poland?

An unemployed person, in order to maintain his status, cannot conduct unregistered activity based on civil law contracts, including agency contracts, contracts of mandate, contracts for specific work or contracts for assistance with harvesting. Conclusion of this type of contract will result in the unemployed person losing his status.

In practice, if the activity of an unemployed person is based solely on sales contracts, then this person may conduct unregistered activity.

Can pensioners conduct unregistered business activity in Poland?

There are no restrictions which forbid a person receiving a pension to engage in unregistered business activity.

How does conducting unregistered activity affect consumer rights?

Conducting unregistered activity makes one an “entrepreneur” in the light of civil law.

This means that, in relations with consumers, an entrepreneur carrying out unregistered activity has obligations related to complaints, returns or repairs. This also applies to the consumer’s right to withdraw from a distance contract within 14 days.

What if the income due from unregistered activity exceeds the monthly revenue threshold?

If the income due from unregistered activity exceeds the monthly revenue threshold, this activity becomes an economic activity from the day on which the excess occurred. In this case, an application for entry into CEIDG should be submitted within seven days from the date on which the threshold was exceeded.

Can unregistered business activity in Poland be conducted intermittently?

There are no restrictions when it comes to conducting unregistered gainful activity in Poland on a non-continuous basis.

Can I legally advertise and promote my unregistered business in Poland?

You may advertise and promote your unregistered business activity using, for example, websites and social media.

When running an unregistered business in Poland, can I deduct the costs incurred in my annual tax return?

In your annual tax return (PIT-36), you may deduct the costs you incurred in connection with your business. You should document costs pertaining to the purchase of raw materials, electronic devices, furniture, and the production of goods. Be sure to keep all receipts in a safe place.