Buy to let in Poland is a great choice for investors who wish to generate a steady income.

The number of foreigners buying apartments in Poland reached an all-time high in 2022. Indeed, foreigners purchased 14,359 apartment units in that year. In 2023, foreigners bought 14,346 apartments in Poland.

I recently had the pleasure of assisting a British man with Polish citizenship to buy an apartment as an investment.

Finding Poland has already produced this guide to buying an apartment in Poland. Thus, I only make brief references to the buying process in Poland in this post.

This post emphasises the bureaucratic procedures involved when it comes to renting out an apartment.

Gdańsk-based estate agent, Ms Ada Słotkowicz, representing Nowodworski Estates,* swiftly found suitable tenants for the property. She agreed to contribute her expertise and knowledge of the letting process in Poland and the rental market in Tri-City to support this post.

So, let’s dive in to check the steps for with regard to buy to let in Poland:

* Please note that Nowodworski Estates changed its name to homfi

Should you go it alone or approach a letting agency to rent out your apartment in Poland?

Based on my own observations, it is worth hiring a letting agent to help smooth the letting process.

Initially, my colleague and I placed an independent advert on Otodom. Otodom is the biggest and most popular real estate website in Poland. Back in 2020, we paid 59 PLN to place an advert on the site. There are more expensive packages available. Click here to see them.

After a few days, we also placed a free advert on Gumtree.

The response to our private adverts was rather disappointing. We only received two calls in ten days. Only one of those callers decided to view the flat.

During those ten days, my colleague also reduced the rent several times. The original price was 2350 PLN. His last price was 2200 PLN, which included a parking space in the underground garage.

Fed up with the lack of interest, my colleague decided to liaise with Nowodworski Estates after they had made a call to him to see whether he was interested in cooperating.

I’m sure that many landlords do eventually succeed in letting their properties via their own private adverts.

Nevertheless, our experience with Nowodworski Estates proved to me that it’s worth paying a fee to an agency. The reason is because a reputable agency arranges flat viewings, draws up a tenancy agreement and compiles the protocol of delivery and acceptance. This is just the tip of the iceberg when it comes to the services a decent agency can offer you.

Buy to let in Poland – What can a reputable real estate agency do for you?

We’ve already established that hiring a property agency may well be a smart move.

So, let’s examine what a creditable Polish estate agency, like Nowodworski Estates, can do for you:

1. Mass property aggregation and a frictionless and swift rental of your property

It’s natural – a good property agency has contacts. Lots of them. In addition, Nowodworski added the offer to over 80 property websites. So, mass exposure of the flat was the name of the game.

Based on real life statistics, Nowodworski proudly boasts an average period of 15 days to find a suitable tenant. As agent Ms Ada Słotkowicz said:

❝ Our stated average let time of fifteen days can of course extend or shorten depending on market conditions. Some rentals may take only a few days while another may take three to four weeks. It all depends on factors such as the time of year or the willingness of the landlord to adapt the rental price according to current market conditions.

Well, my colleague signed a contract with Nowodworski on September 18. Ms Słotkowicz found a tenant at the end of the month. The lady agreed to rent the flat from October 2. Timewise, my colleague was more than satisfied with how things panned out.

2. Detailed tenant checks

Yes, finding tenants quickly is one of Nowodworski’s main goals. However, as Ms Słotkowicz said:

❝ Our service ensures we deliver responsible tenants who are financially viable with long term employment.

Nowodworski thoroughly screened the tenant, checking her reliability and solvency. Obviously, this was a valuable source of comfort for my colleague.

It wouldn’t be in an estate agency’s best interests to find any old person to rent a property. After all, Ms Słotkowicz was banking on my colleague to use Nowodworski’s services again when this tenancy agreement was due for renewal the following year.

3. Professional photography and attention to detail

My colleague and I thought that this buy to let in Poland adventure would be so simple. Take a few pictures of the flat for our own self-created adverts – and the rest would take care of itself.

How wrong we were to hold such a belief.

The photographs produced by Nowodworski’s professional photographer showed the flat in its true colours – light, bright, clean and homely. The photographer also created a video walkthrough.

Just the ticket.

4. Setting the terms of the rental contract and preparing the contract’s annexes

There are plenty of rental contract templates on the Internet.

However, it’s reassuring to have an experienced real estate agent help set the terms of a lease agreement.

What’s more, Nowodworski’s contracts are compiled in both English and Polish. This saved some significant bother for my colleague whose Polish is very rusty..

My colleague opted for an occasional lease agreement (Umowa najmu okazjonalnego) instead of a standard agreement. More on these two types on contract below. Just to add that my colleague ended up with a sixteen-page contract that protects him very well.

Ms Słotkowicz also prepared four important annexes to the contract. Three of these are related to the occasional lease agreement. I will mention these attachments below. The fourth annex was the Protocol of Delivery and Acceptance.

5. Protocol of delivery and acceptance (Protokół zdawczo-odbiorczy)

When it comes to letting an apartment, the landlord is not obliged to draw up a Protocol of Delivery and Acceptance. Nevertheless, if both parties sign a protocol, it will help to avoid any potential disputes and tension down the line.

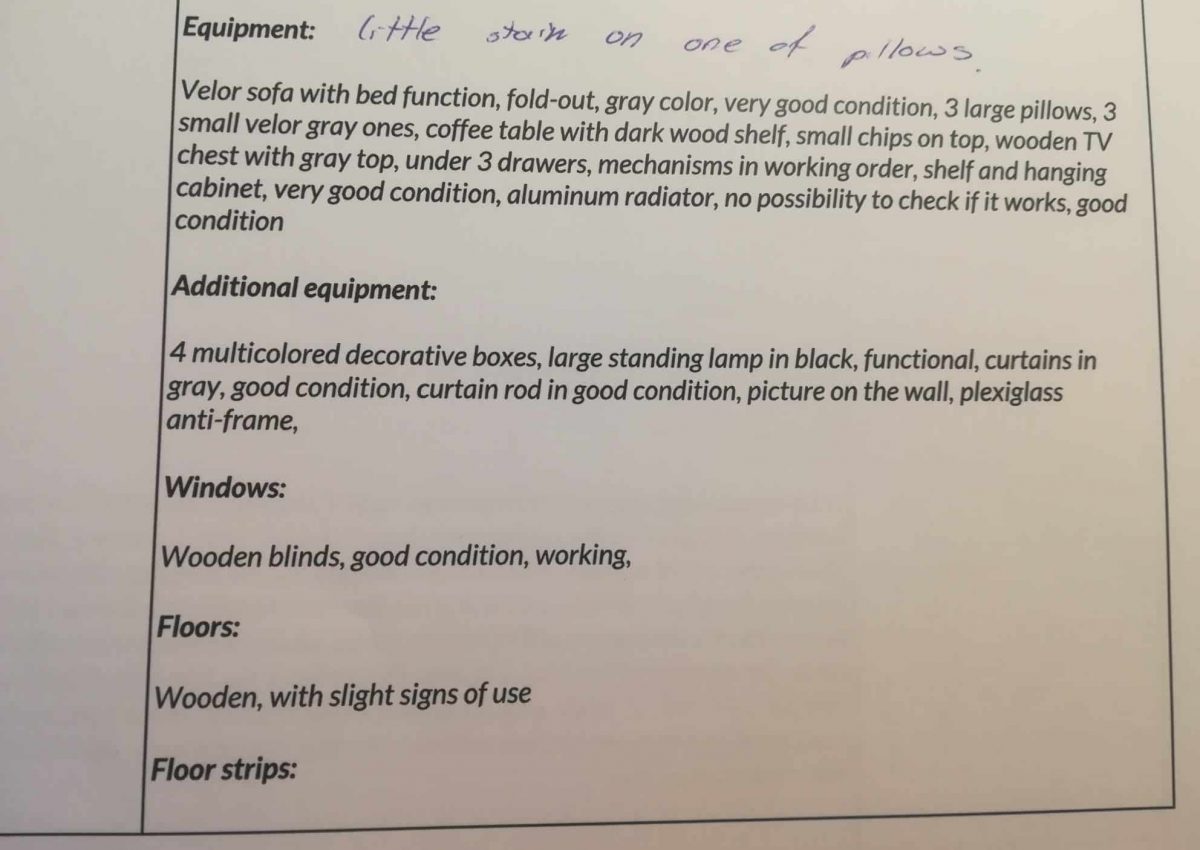

Ms Słotkowicz compiled an exceptionally detailed fourteen-page protocol of delivery and acceptance. It includes a description of the technical features of the premises. These features include the condition of the window frames, woodwork, flooring, electrical installation and walls.

To the minutest of details, Ms Słotkowicz also described the condition of the furniture, equipment and appliances. Here are a few descriptions from my colleague’s Protocol of Delivery and Acceptance:

Some of these descriptions may seem trivial. However, I agree with the approach. These descriptions serve to put a landlord’s mind at ease and sternly remind the tenant that they should treat the property as their own.

On the day the tenant moves in, it’s also necessary to read the electric meter, water meters and central heating meter. Ms Słotkowicz did just that and added the meter readings to the Protocol of Delivery and Acceptance.

Overall, Ms Słotkowicz did a wonderfully accurate and thorough job putting this protocol together.

6. Dealing with a notary public and assuming the role of power of attorney

Ms Słotkowicz arranged a slot for my colleague at a notary public. An occasional lease agreement cannot be concluded without the participation of a notary public.

The occasional lease agreement itself does not have to be concluded in the form of a notarial deed, i.e. with the participation of a notary. However, a notary public is involved in preparing one of the annexes to this agreement. This annex is the tenant’s declaration of submission to enforcement (oświadczenie o poddaniu się egzekucji).

Ms Słotkowicz offered my colleague to grant her power of attorney to deal with everything at the notary. He was confident that Ms Słotkowicz was on the ball with everything, so he didn’t hesitate to agree. Not to mention that Ms Słotkowicz’s kind offer saved him paying 300-400 PLN for a Polish-English sworn translator.

7. Exclusivity and a personal touch

Signing an exclusive property lease agreement with an agency may bear fruit for foreigners seeking a super swift buy to let in Poland.

My colleague signed an exclusive property lease contract with Nowodworski. In other words, my colleague had to refrain from activities aimed at acquiring tenants through the services of other real estate agents.

So Ms Słotkowicz didn’t have any competitors. A chance for her to relax, right?

Not quite.

When the agent is aware that their work is going to result in a sure reward, they try harder to get a property rented.

Besides, exclusive contracts don’t last a lifetime. Indeed, Nowodworski concludes exclusive agreements for a period of two months. This was enough to give my colleague the confidence that Ms Słotkowicz would get the job done.

On the topic of “exclusivity”, Ms Słotkowicz said that:

❝ Exclusivity is our way of sealing a meaningful collaboration with a client while also offering them all of the benefits the investment our agency subsequently spends on ensuring a frictionless rental of their property. These perks include unrivalled service and regular reporting, detailed tenant checks, property aggregation to over 80 property websites, video walkthroughs, careful home staging, pricing analysis, floor planning, professional cleaning and collaboration with corporate personnel relocation.

Overall, a combination of exclusivity and eagerness on the part of a well-trained agent was always going to produce a positive outcome.

Different Types of Lease Agreements in Poland

In Poland, landlords tend to use either one of two types of lease agreements when letting their property:

1. Regular Residential Agreement

The first type of lease agreement is a regular residential lease contract (Umowa najmu lokalu mieszkalnego). This is a standard civil law contract with provisions that are regulated by the Civil Code.

If I were a landlord, I’d never sign this standard agreement with any tenant. In the case of disputes, Polish law strongly protects the rights of tenants. If tenants do not pay their rent on time or refuse to leave the apartment, then the landlord may have problems evicting them.

It’s possible that many landlords sign the standard contract so as to go unnoticed by notary officials and, ultimately, the tax office.

2. Occasional Lease Agreement

A residential real estate occasional lease agreement (Umowa najmu okazjonalnego) offers increased protection to the landlord. This form of lease can only be used by natural persons who do not conduct business activity.

First of all, a landlord doesn’t need to endure lengthy court proceedings to evict a tenant with an occasional lease agreement. This is because the landlord is protected by the tenant’s declaration of submission to enforcement (oświadczenie o poddaniu się egzekucji). More on this declaration shortly.

On the subject of eviction, Ms Słotkowicz said:

❝ If a tenant chooses not to pay rent, the landlord cannot evict the tenant if they have nowhere else to stay, if they are of a certain age or if it is winter time. So, from this perspective, the removal of such a tenant could take anything up to ten years when it concerns a regular lease agreement. In such cases, an occasional lease agreement allows the landlord to start the eviction process much sooner.

I do not mean to scare potential landlords here. The vast majority of tenants are responsible people who pay their way in life. To put things into perspective, Ms Słotkowicz confirmed that:

❝ I have never personally encountered a potential tenant who has raised an objection [to an occasional lease agreement]. This kind of lease agreement shouldn’t be seen as something out of the ordinary. The trustworthy tenants have nothing to worry about and landlords can relax knowing they are protected against any unforeseen circumstances.

What does an occasional lease contract broadly consist of?

My colleague’s contract is a sixteen-page document. It contains all the specific and general terms of lease which one would expect to find in a standard rental contract. Clauses relate to:

- the delivery of the premises to the lessee

- duration of the agreement

- information about the rent, security deposit and administrative fees

- insurance

- the lessee’s rights and obligations

- the lessor’s rights and obligations

- lease agreement termination

- return of the premises

- final provisions

Execution of a demand to vacate the premises

Things begin to get interesting in section 9 of my colleague’s contract. This section is titled: Execution of a demand to vacate the premises.

Now, we come to the aforementioned declaration of submission to enforcement which a tenant has to sign at the notary public.

The first annex of four is the lessee’s declaration of submission to enforcement in connection with the occasional lease agreement (oświadczenie o poddaniu się egzekucji). This is a declaration in the form of a notarial deed, in which the lessee subjects himself to enforcement. In other words, the lessee undertakes to vacate and surrender the premises within a specified time limit.

In the contract, point 4 of section 9 states that:

After the expiry or termination of the Agreement, if the Lessee has not voluntarily emptied the Premises, the Lessor shall deliver to the Lessee a written request to vacate the Premises along with an indication of the date in which the Lessee and the persons residing with him shall empty the Premises. The above-mentioned date shall not be shorter than 7 days from the date of delivery of the request.

In the event of an ineffective expiry of the time limit referred to in point 4, the lessor has the right to submit to the court an application for granting an enforcement clause to the aforementioned notarial deed.

The court will consider a request within three days, after which an expedited eviction procedure will begin. This may occur during the winter months, something which a standard lease contract does not allow by law. Moreover, neither minors nor pregnant women are protected against any potential eviction procedure.

Which other statements relate to the execution of demand to vacate the premises?

The second annex is a statement containing the lessee’s indication of another premises in which the tenants will be able to reside in the event of execution of the demand to vacate the rented premises. This is referred to as Wskazanie przez Najemcę innego lokalu in Polish. For this, the lessee wrote and signed a handwritten declaration.

The third annex is a declaration of consent to the lessee’s residence in another premises (oświadczenie o wyrażeniu zgody na zamieszkanie najemcy w innym lokalu). Here, the owner of the premises referred to in the second annex provided consent to the residence of the tenants should they be evicted.

The fourth annex is the protocol of delivery and acceptance, which I’ve already written about.

Tax affairs when letting out an apartment in Poland

After finishing all the paperwork and handing over the property to the tenants, my colleague made his way to the tax office to report his forthcoming rental income.

Let’s check the steps involved when it comes to setting one’s tax affairs in order:

1. Notify the tax office of an occasional lease agreement

In the case of an occasional lease agreement, the landlord should notify the tax office within 14 days from letting the apartment.

You may download a model notification form here. Accept the terms and conditions (Akceptuję regulamin serwisu jakiwniosek.pl) then Click on ‘Pobierz dokument’.

The notification informs the tax office of the date from which the contract was concluded. There are also spaces to fill in the landlord’s personal details and also the address of the apartment.

My colleague filled out this form and took it with him to the tax office. He had other duties to carry out there, as we shall now go into.

2. Registration of a natural person who is a taxpayer

Aware that my colleague hadn’t yet registered as a taxpayer in Poland, the clerk gave him the ZAP-3 form to fill in.

The ZAP-3 is for natural persons, whose tax identifier is their PESEL number. My colleague has had a PESEL number for several years.

Natural persons are those who do not conduct business activity, are not registered as VAT payers, and do not pay taxes or social security contributions.

On the ZAP-3, the taxpayer has to fill in basic information such as personal details, home address, correspondence address and personal bank account details.

3. Decide on a taxation rate of rental income

A landlord (not conducting business activity) may choose one of two existing forms of taxation of rental income:

Progressive income tax scales:

First of all, private rental can be settled according to the income tax bands in Poland (17% and 32% of income). The 17% rate applies to income not exceeding 85,528.00 PLN per year. Rental income is added to the income from other sources, for example, from an employment contract. Therefore, there is a risk of entering the 32% tax band.

These income tax scales are mostly applicable to entrepreneurs who conduct business activities. Landlords who rent several premises should settle accounts as entrepreneurs, especially if they have no other income.

These income tax bands are also advantageous to landlords who may deduct expenses related to the apartment from the income obtained from the lease.

The sheer range of costs that can be deducted is very extensive. For example, mortgage interest, home insurance, repairs and the purchase of equipment are all feasible expenses.

In order for a given expense to be considered a cost, it should be properly documented. In other words, a landlord should keep invoices or bills.

Lump sum tax rates:

In contrast to paying tax according to one of the income tax scales, a landlord may choose to pay a lump sum.

From 2018, a lump sum rate of 8.5% applies to income up to the amount of PLN 100,000. A rate of 12.5% applies to the surplus over PLN 100,000.

My colleague was aware that he wouldn’t have any significant expenses related to the apartment. For instance, he doesn’t have a mortgage to pay off. Moreover, he didn’t have to carry out any repairs in the apartment. Therefore, the 8.5% rate was the most appealing option for him.

In an occasional lease contract, it’s vital to state that the tenant will bear fees related to the premises. These fees include electricity, water, gas and monthly communal fees (czynsz). If the contract does not explicitly state that the tenant will cover these fees, yet the tenant still transfers money into the landlord’s account for them, this income is taxable.

If the landlord decides to pay tax in the form of a lump sum, he should submit a written declaration of this choice to the tax office. The deadlines for informing the tax office of this choice are as follows:

- until February 20, if the first income is in January

- by the twentieth day of the SUBSEQUENT month in which the landlord obtained the first rental income

- until the end of February (when the tax year ends), if the first such income appears in December

A delay in submitting a declaration results in the loss of the right to choose a lump sum rate. Under such circumstances, the landlord has to pay taxes according to the progressive income tax scales.

4. Pay tax into an individual micro-account

So, my colleague informed the tax clerk of his preferred way to pay tax. Thereafter, the clerk set up an individual tax micro-account for him.

This micro-account is an individual tax account which is used for PIT, CIT and VAT payments.

My colleague’s identification number is his PESEL number.

In sum, my colleague was obliged to transfer 8.5% of the total rent to his micro-account by the twentieth day of the month following receipt of the first rental fee.

Further information about tax micro-accounts can be found here.

5. Submit PIT-28 for lump sum settlements by the end of the tax year

The final piece of the puzzle for my colleague was to file his taxes for 2020.

Taxpayers who choose a lump sum settlement have to submit the PIT-28 tax form.

For the 2023 tax year, the deadline for filling in the form is April 30, 2024.

Is now the time to invest in real estate in Poland?

I am confident that cash buyers who are not afraid to partake in some hard bargaining would be able to grab a fabulous rental yield in any major Polish city. By fabulous, I mean anything over 5.5%.

Let’s also not forget the prospect of significant capital appreciation of Polish real estate in the future.

Don’t be put off by the bureaucratic procedures mentioned in this article. Polish bureaucracy is much easier to handle than it used to be. Besides, a professional real estate agent can do most of the heavy lifting for you.

If you’re in Gdańsk, Wrocław, Warsaw or Kraków, do contact Homfi to help you buy and let an apartment.

If you’re wondering whether you are legally entitled to buy a house in Poland as a foreigner, check out this post:

Can a Foreigner Buy a House in Poland?

What an in depth article about purchasing real estate in Poland. And congratulations on buying in Gdansk. I am years away from making a real estate decision myself but it never hurts to start getting informed early on. I’ve been fantasizing about a “return” to Poland for quite some time now, specifically, to Sopot. I was born in Gdynia and lived in Sopot until leaving for Canada as a young girl. Living there, even for a few (informative) years, has left a permanent impression on me, and afforded many beautiful childhood memories. You can imagine my excitement when I was able to stroll down my old street via google (ulica obroncow westerplatte), when there was little chance of visiting in person. I’ve visited a few times and was hoping to go to Sopot (and catch up with remaining relatives) this past summer with my two daughters but was wary about travel, given the current climate. This would have been their first time there.

I often show photos of Sopot and other parts of Poland to them and they are truly eager to visit, if for no other reason than to finally put an end to my “show and tells” which involve faded photos, tourist websites and webcams. Needless to say, I’m hoping to visit at the first opportunity. In the meantime, I’m happy to have come across your blog, and sincerely enjoy and appreciate the warmth and sensitivity with which you write about my homeland.

Stay well,

Natasza Dusko

Thank you Natasza for your kind words.

You take care too.

Steve